Information about Iran | Business Etiquette in Iran

Information about Iran

- An Introduction to Iran

- Business Information

- Understanding Iran

- The Constitution and Government

- The Economy

- Opportunities for Investment

An Introduction to Iran

This section contains helpful information for companies wishing to start or recommence trading with Iran post lifting of the sanctions. Since signing the nuclear deal in 2015, Iran's government has made significant attempts to attract investment into the country and offers Western business large market opportunities.

The country has already attracted significant investment in a range of sectors, including infrastructure, utilities, hospitality, oil and gas. British Airways resumed regular, direct flights to Tehran in 2015, so Iran is now only a five-hour flight away for visiting British businesses.

BICC aims to help prepare British companies with up to date knowledge and advice to help in the making decisions when trading with Iran. This website aims to give an introduction to the culture of Iran, its geostrategic importance, the opportunities for trade post lifting of the sanctions and how to navigate the Iranian marketplace.

Why Iran is a Good Prospect for British Trade.

Iran is one of the fastest growing economies in the Middle East, and with the end of its international isolation, British companies now have the opportunity to trade with the largest market to re-enter the global economy in many years.

Iran has the second largest economy in the MENA Region after Saudi Arabia, with an estimated nominal GDP of $438 billion in 2017, and the second largest population of the region after Egypt. Also, based on PPP (purchasing power parity), Iran has the 18th largest economy in the world.

With a total population of 80 million, over half of which are under the age of 30, it is an educated, urbanised and tech-savvy population. Iran has a literacy rate of over 95%, over one million university students, and over 600,000 university graduates annually. This constitutes a huge, brand-conscious consumer market located in a geo-strategic location. Also, Iran has some of the largest oil and gas reserves in the world and presents a vast range of business opportunities in virtually all sectors of its diversified economy. What is more, Iran contains a number of Free Trade Zones, some of which offer tax advantages for international companies.

The country has much economic potential, and the government of Iran is ready for renewed investment and more trade. As the momentum for companies to enter Iran accelerates, it is very important for British companies to establish links and connections with Iran. The British government fully supports and encourages UK companies to take advantage of the commercial opportunities as they arise. Philip Hammond, the former Secretary of State for Foreign and Commonwealth Affairs, was quoted saying, 'I hope British businesses seize the opportunities available to them through the phased lifting of the sanctions on Iran.'

Iran is currently buzzing with international companies competing for a share in the market and UK companies can take a share of the market also. Iranian companies are keen to work with their British counterparts, valuing their quality and reliability. Iran has a thriving entrepreneurial culture, stimulated by new start-ups and tech companies which provide alternatives to their Western counterparts who are not able to operate in Iran due to the banking restrictions.

Iran's economy is set to grow exponentially; McKinsey Global Institute estimates that it could be a one-trillion-dollar economy by 20351. Foreign investors are set to play a key role in this, providing international expertise, and investments in the infrastructure and in financial systems, which are expected to significantly increase Iran's productivity. However, some sanctions remain, so it is important to understand your Iranian partners' business profile, take due diligence measures, and consider how and to whom payment will be made, to ensure compliance with all sanction restrictions. Payments will be discussed further in the Trade Sanctions section of the website. Research and preparation should be undertaken beforehand in matters such as sanctions, banking and licensing matters.

A Brief History of Iran

Iran is one of the world's oldest civilisations, with settlements dating back to 4000 BC. Sitting in the heart of the ancient Silk Road, it's strategic location made it a major transit and commerce route, sparking Iran's interest in international trade.

The country became an Islamic Republic in 1979 when the monarchy was overthrown, and religious clerics assumed power under Ayatollah Khomeini. Tehran is now a modern, vibrant city, ripe for investment from the West.

Geography

Located on the Silk Road, between the Middle East, Europe and Asia, Iran has a natural position for trade, as well as having the second largest gas reserves and fourth largest oil reserves in the world.

The country borders Afghanistan, Armenia, Azerbaijan, Iraq, Turkey, Pakistan and Turkmenistan. It also has easy access to port facilities, as it borders the Caspian Sea in the North and the Persian Gulf and the Gulf of Oman in the South.

The main cities in Iran are:

- Tehran

- Mashad

- Karaj

- Isfahan

- Shiraz

- Tabriz

Tehran

Tehran is the cultural and economic centre of Iran and is a dominant regional power exerting considerable influence over the region

- The North of Tehran is the most affluent area, with the best hotels, restaurants and coffee shops

- The commercial and business hub is from the centre of the city at Enghelab Square to the North of Tehran through Valiasr Street

- The location of most of the government departments of business is in the Enghelab area of the city

- South of Enghelab is the less affluent residential section of Tehran, which is less frequented by tourists and foreign business people

Religion

Shi'a Islam is the official state religion in Iran. Christians, Zoroastrians and Jews are recognised religious minorities. The laws in Iran are based on Islamic principles and decrees.

Transportation

Iran has a sophisticated network of public transport, including the metro, buses, trains, taxis and internal flights. There is a women's section on the metro and bus which is strictly women-only. However, women are permitted to enter the men's sections when it is less busy to sit with their male companion.

Imam Khomeini International Airport is the main international airport in Iran, located around 30km (around 40 mins) from Tehran. It is recommended that you book a CIP (commercially important person) ticket for your return trip to the UK. CIP is a service that you can book at the airport which will give you a faster boarding time and access to a private lounge to wait for your flight.

The main port in Iran is Bandar Abbas port, which handles around 90% of the country's container throughput. The main export terminal is Kharg Islam, roughly 90% of Iran's exports are sent via Kharg.

Language

The official language of Iran is Persian; however, the English language is widely spoken in business. Many Iranian business people have been educated in the West.

Tourism

Tourism to Iran from the West is on the rise, as travellers are drawn to visit its authentic and timeless sites in one of the few places still untouched by mass-market tourism. Iran ranks in the top 10 in the number of UNESCO world heritage sites and offers some stunning ancient places, such as the legendary city of Persepolis, and some of the most spectacular mosques, palaces and architecture on the planet. Also, Tehran contains many winter ski slopes, which offer a fantastic ski season to rival Europe.

Developing the Iranian tourist market will require significant investment in its airlines, airports and hotels. In addressing this need, several international hotel chains have begun entering the market, including Accor, Rotana, and Melia Hotels International, which plans to open the luxury Gran Melia Ghoo, the country's first international five-star start hotel, on the Caspian Coast in 2017. Even Britain's own EasyHotel chain is set to open hotels in Iran. Therefore, there are several 4/5* hotels which are starting to match their Western equivalents regarding quality and service.

If you are looking to visit a trade show in Tehran International Permanent Fairground for example, the nearest hotel would be Parsian Azadi International Hotel, a five-star hotel. Tehran International Permanent Fairground holds tens of international exhibitions every year, making it a popular hub for international business in Iran.

Time Zone

GMT + 3.5 hours (+4.5 during British Summer Time)

Business Information

Differences in Calendar and Working Week

The governmental fiscal year runs from 21st March to the 20th March.

The date in Iran is currently 1396, 622 years behind the Gregorian calendar. The Iranian calendar begins with the migration of the Prophet Muhammad from Mecca to Medina in 622.

The working week is generally from Saturday to Wednesday; however, some private companies are open for half a day on Thursday.

Understanding Iran

Dress Code - Women

Women are well represented and welcome in the Iranian business world. Shown below are the various ladies' outfit options and conduct to enable foreign visiting women to do successful business on an even playing field in the Islamic Republic.

An Islamic dress code or 'hijab' is enforced in Iran, and all tourists and foreigners must respect this style of dress. Hijab is the Arabic word for covering and a symbol of modesty.

- For women, hijab means covering your body and hair completely, normally with a loose outfit and headscarf, revealing only your face and hands

- You should cover your head with a scarf before you enter the Imam Khomeini Airport. Often flight staff will instruct you to cover your head when entering Iranian airspace. It is thus imperative to take along a scarf on any flight to Iran.

- In all business settings, it is imperative for women to cover themselves, their head and hair entirely

- You should wear a 'manteau', which is a loose-fitting coat that covers the chest area, arms and goes down to the thighs

- If your scarf falls off you head, you will be politely asked to cover your head by passers-by or the religious police

- Hijab must be worn in all public places, even in 5-star hotels

- Monteau's can be very fashionable, and we would recommend investing in a stylish 'manteau' that you can wear to business meetings. Black is recommended for business meetings but not essential

- You can wear trousers, leggings and a shirt under the 'manteau'

- Women in governmental offices and or schools will wear a 'magne', a more formal scarf that is tightly fitted to the head

- The chador is the Iranian national religious garment, covering the entire body

Dress Code - Men

- Men's fashion is similar to Western men's fashion, though shorts are unacceptable in Iran

- In business Iranian men do not wear ties; however, it is acceptable for visiting businessmen to wear them

- Clothes should not be too tight

Conduct

In a Business Setting

- Iranian business culture is very conservative, and it is common to see pictures of Ayatollah Khamenei and Khomeini on the walls

- Although there are many women in Iranian business, it is not acceptable for members of the opposite sex to shake hands or kiss

- The best approach is to wait to see if your Iranian counterpart offers their hand, and if they do not, you should abstain and merely give a small head bow of acknowledgement

- For members of the same sex, a quick handshake is acceptable

Inappropriate Gestures

- A thumbs up is considered rude

- Pointing at people is considered very rude

- You should avoid turning your back to people or sitting with your back to others, and should apologise if you need to

Tarof

- Literally meaning 'offer', 'tarof' is a cultural ritual whereby Iranians are overpolite, but they do not necessarily mean what they are saying

- Tarof indicates humility and respect but can often be confusing to a foreigner:

- Shopkeepers and taxi drivers will often refuse several times before accepting payment

- People will generously offer their personal effects, such as an item of clothing, if you show interest in them, even though they do not want to give them to you

- In restaurants, buses, or trains, Iranians will offer to share the food that they are eating

- It is important to bear this in mind in a business setting, where your hosts may make grand promises, but not necessarily mean what they say

Approach to Business

- Prepare for meeting times to be changed at the last minute, or to run over. Time schedules are less rigid in Tehran than in The West

- It is important in a business meeting to address your counterpart by their title and surname. The use of first names is normally reserved for private meetings after a personal relationship has been established

- Although a good first meeting may bode well, it does not guarantee success. You must follow the process of negotiating carefully and be constantly diligent.

- Until things happen, they are not finalised

- It is important to exchange goods at the same time as payment

- Avoid engaging in political conversations

- Try to avoid arranging business meetings between the 20th March and the 8th April, as this is Iranian New year and a national holiday

- During the month of Ramadan, it is important to be aware that it is prohibited to eat or drink in public during daylight hours. Although business continues, it is unusually at a slower pace, so it is best to avoid big business trips outside of the month of Ramadan

Money

- The currency of Iran is the Rial, although it is more common in Iran to speak in Tomans - this can cause some confusion!

- 10 Rials= 1 Toman

- Your credit and bank cards will not work in Iran; therefore you need to bring enough hard cash with you to cover you for the duration of the trip

- It is recommended to bring the equivalent of £100 a day

- You can bring cash in pounds, dollars or euros, and change them at a currency exchange (called a serafi) when needed

- You will need a passport or a photocopy of it to exchange cash

- Currency exchanges are located in hotels and throughout Tehran

- Tipping is welcomed, but not expected.

Food and Drink

- Alcohol and pork are strictly forbidden in Iran, and will not be served

- Lunch is typically eaten at around 12:00-15:00 and dinner is often eaten after 20:00

- If invited for a meal, it is typical to bring a small gift of flowers or pastries (small gifts from England will be gratefully received, shortbread, sugared almonds, tea from British brands etc.)

- There are several high-end restaurants in Tehran which can be used for meetings

- The best restaurants in Tehran, all located in the North are:

- Divan, serving Persian/Western fusion food (good for business meetings)

- Monsoon, a Persian twist on Asian cuisine

- Shandiz Garden Restaurant, traditional Persian food

- It is common to tip in high-end restaurants

- Traditional dishes you should try:

- Shashlik Kebab (lamb chops)

- Ghormeh Sabzi (An Iranian herb stew, the Iranian national dish)

- Fesenjoon (a pomegranate and walnut stew)

- Dizi (lamb stew)

- Traditional ice cream (flavoured with saffron and rose water)

Technology

- You can buy Iranian Sim cards easily in Iran; you can ask your hotel or host to purchase a 'pay as you go' card or purchase one at the airport of a shop.

- Facebook, Twitter and many news sites including the BBC, The Daily Telegraph, and The Times are blocked in Iran. You can, however, access the Guardian and Aljazeera

- Social media such as WhatsApp, Instagram and Telegram work in Iran. Telegram is the most popular form of social media in Iran and can be used on both computers and smartphones as an App. It is recommended that you download Telegram

- If you are concerned about documents on your laptop or phone, you may want to consider encrypting or not bringing them

Health

- Tap water is drinkable in Iran

- Make sure your health insurance is up-to-date, as hospitals do not give free health care

- Apart from being up-to-date with usual travel vaccinations, no special preparation is needed for a trip to Iran. Those intending upon travelling to the region of Sistan Baluchistan should be vaccinated against malaria

- Recommended hospitals in the North of Tehran with English speakers include Milad Hospital, Atiyeh Hospital, Mehrad Hospital, Dey Hospital and Jam Hospital.

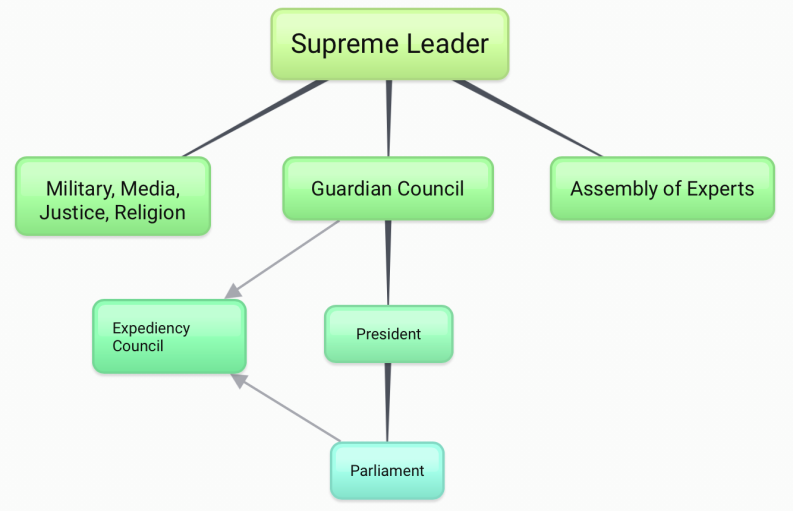

The Constitution and Government

Following the 1979 revolution, Iran is now an Islamic Republic. Under the constitution, all democratic procedures and rights in Iran are subordinate to the Supreme Leader and the Guardian Council, who have an understanding that God's divine nature is fundamental in setting laws, and their laws are based on Islamic principles. Therefore, Iran's political system combines elements of democracy and religion.

The Make-up of the Government

The central government consists of a Supreme Leader, President, Parliament, Assembly of Experts, Guardian Council and Expediency Council.

Supreme Leader

The Supreme Leader is the head of state and the highest ranking religious and political authority in Iran. His role is to oversee and coordinate the main policies of the government, control the armed forces and make the final decisions on security, defence and major foreign policy issues. The current Supreme Leader is Ayatollah Ali Khamenei, has been in this position since 1989.

The Supreme Leader appoints the Head of Justice, six of the members of the Guardian Council, the Expediency Council, the Commanders of the armed forces and the head of the National Radio and TV Institution. The Supreme Leader is chosen by the Assembly of Experts and relies on these Experts and the Expediency Council to facilitate decision making and resolve administrative conflicts between the three branches; judicial, legislative and executive.

President

President Rouhani was re-elected as the 7th President of Iran for a 2nd term in August 2017. He was elected by direct vote of the Iranian population and is a moderate, who has made promises to improve the economy and engage with the West.

The President is the second-highest ranking official in the country, and is elected for four years and can serve no more than two consecutive terms. He is the head of the executive branch of power, and responsible for ensuring the constitution is implemented.

Guardian Council

The most influential body in Iran; all legislation must be approved by the Guardian Council. It is made up of six theologians selected by the Supreme Leader, and six jurists elected by the Parliament, from a list of jurists nominated by the chief of justice.

They approve all bills passed by Parliament and have the power to veto them if they consider them inconsistent with the constitution and Islamic Law. The Council supervises elections and can also bar candidates from standing in elections for Parliament, Presidency and the Assembly of Experts.

Assembly of Experts

The Assembly consists of 88 seats on an eight-year term and is elected by public vote. They appoint the Supreme Leader, monitor his performance, and remove him if they deem him incapable of fulfilling his duties.

The Parliament (Majlis)

The parliament consists of 290 seats and is elected by public vote. It holds legislative power and supervises the President and delegation of ministers, and ordains the laws.

Expediency Council

The Expediency Council determines any disputed acts of legislation, acting as a mediator between parliament and the Guardian Council. The council is appointed by the Supreme Leader on a five-year term.

The Armed Forces

The Armed forces consist of the Revolutionary Guard and the regular forces. The Revolutionary Guard was formed after the revolution to protect the new leaders and institutions and to fight those opposing the Revolution.

The Government

| Ali Khamenei | Supreme Leader |

| Dr. Seyyed Ebrahim Raisi | President |

| Mohammad Bagher Ghalibaf | Speaker of Parliament |

| Gholam-Hossein Mohseni-Eje'i | Chief of Justice |

| Ahmad Jannati | Chairman of the Assembly of Experts |

| Ahmad Jannati | Chairman of the Guardian Council |

| Sadeq Larijani | Chairman of the Expediency Discernment Council |

Vice Presidents

| Dr Mohammad Mokhber | First Vice President |

| Dr Gholam Hossein Esmaili | Chief of Staff |

| Dr Seyyed Solat Mortazavi | Vice President for Executive Affairs |

| Dr Meysam Latifi | Vice-President and Head of the Administrative and Recruitment Affairs Organisation |

| Dr Mohsen Rezaei Mirghaed | Vice-President for Economic Affairs |

| Mohammad Eslami | Vice-President and Head of the Atomic Energy Organisation |

| Dr Seyyed Masoud Mirkazemi | Vice-President and Head of Plan and Budget Organisation |

| Dr Seyyed Amir Hossein Ghazizadeh Hashemi | Vice-President and Head of the Martyrs and Veterans' Affairs Foundation |

| Dr Mohammad Dehghan | Vice-President for Legal Affairs |

| Dr Ensieh KhazAli | Vice-President for Women and Family Affairs |

| Dr Seyyed Mohammad Hosseini | Vice-President for Parliamentary Affairs |

Ministers

| Alireza Kazemi | Acting Minister of Education |

| Dr Issa Zarepour | Minister of Communication and Information Technology |

| Hojjatoleslam val-Moslemin Seyyed Esmail Khatib | Minister of Intelligence |

| Dr Ehsan Khandouzi | Minister of Economic Affairs and Finance |

| Dr Hossein Amir Abdollahian | Minister of Foreign Affairs |

| Dr Bahram Einollahi | Minister of Health and Medical Education |

| Dr Hojjatollah Abdolmaleki | Minister of Labour and Social Welfare |

| Dr Seyed Javad Sadati Nejad | Minister of Agriculture Jihad |

| Dr Amin Hossein Rahimi | Minister of Justice |

| Brigadier General Dr Mohammad Reza Ashtiani | Minister of Defence |

| Rostam Ghasemi | Minister of Road and Urban Development |

| Dr Seyyed Reza Fatemi Amin | Minister of Industry, Mines and Trade |

| Dr Mohammad Mehdi Esmaili | Minister of Culture and Islamic Guidance |

| Dr Ahmad Vahidi | Minister of Interior |

| Dr Mohammad Ali Zolfigol | Minister of Science, Research and Technology |

| Seyyed Ezzatollah Zarghami | Minister of Cultural Heritage, Handicrafts and Tourism |

| Javad Oji | Minister of Petroleum |

| Ali Akbar Mehrabian | Minister of Energy |

| Dr Seyyed Hamid Sajjadi Hazaveh | Minister of Sports and Youth Affairs |

Other Political Figures

| General Hossein Ashtari | Chief of Police |

| Saeed Khatibzadeh | Spokesman and Head of the Centre for Public and Media Diplomacy of the Ministry of Foreign Affairs |

| Mehdi Chamran Save'ei | Chairman of the City Council of Tehran |

| Ali Shamkhani | Secretary of the Supreme National Security Council |

| Alireza Zakani | Mayor of Tehran |

| Ali Salehabadi | Governor of Central Bank |

The Economy

The Sixth Five-Year Plan

Since the end of the Iran-Iraq war in 1988, Iran's development policies have been formulated in five-year plans, with the first one starting in 1989.

The sixth five-year plan for 2016-2021 was approved by the Iranian Parliament in March 2017 and principally aims to boost foreign investment in the country. The plan envisages an annual economic growth of 8% and discusses reforms of state-owned enterprises and the financial and banking sector. It sets out the following goals and objectives to be achieved by the country over the next five years:

1. Finance Sector

The Government wants to ensure that Iran remains an attractive foreign investment destination introducing new economic, legal and policy directives to increase the transparency and clarity of information in Iran.

The Government wants to attract $30 billion in the form of project finance, $15 billion in the form of foreign direct investment and $20 billion in the form of joint investment agreements.

2. Banking Sector

The Government wants to actively encourage the partnership between domestic and financial institutions and credit agencies.

3. Government Guarantees

The government has been authorised to issue guarantees for foreign investments in projects in Iran's private sector subject to them meeting certain requirements.

4. Legal Sector

The Ministry of Economic Affairs will seek to ensure clarity of existing laws to provide stability to the investment environment and to 'safeguard' foreign investment in Iran. The government will prepare and execute the necessary laws for business and banking for Iranian businesses and financial institutions to become in line with international systems to attract FDI and foreign companies.

Realistically, in the long term, Iran's economic growth prospects will rely heavily on the pace of Iran's reintegration into the global economy in banking, trade and investment. As Iran continues to modernise and renovate its industries, it is likely that the non-oil sector and investments will play an increasingly important role over the next five years.

Click here for further reading on the sixth five-year plan

The British Embassy in Tehran, Iran

The British embassy officially reopened in Tehran on the 23rd August 2015. The former Secretary of State for Foreign and Commonwealth Affairs, Philip Hammond was in attendance, and in his address said that there was no limit to what the two countries could achieve, as mutual trust is restored. The current Ambassador is Nicolas Hopton, with Paul Anderson as the Deputy Head of the Mission.

Located on Ferdowsi Avenue in the centre of Tehran, the Embassy serves to maintain and develop relations between the UK and Iran. Also, the Department of International Trade is also located there and is on hand to offer its expertise to help British companies trade effectively with Iran.

Click here for more information on the British Embassy, and its services and advice.

Major import products:

- Food (cereals)

- Consumer goods

- Industrial supplied

- Technical services

- Capital goods

Major import partners 2016 (source IMF)

- UAE

- China

- Turkey

- South Korea

- Russia

Major five export products:

- Iron Ore

- Cement

- Carpets

- Fruits and nuts

- Petrochemical products

Major five export partners 2016 (source IMF)

- China

- India

- South Korea

- Turkey

- Japan

Opportunities for Investment

There are lots of opportunities for trade between the UK and Iran. As Iran diversifies its predominantly oil and gas-reliant economy and seeks to reinforce the country's infrastructure, British companies who can deliver expertise, investment or equipment to facilitate this will be particularly welcomed and valued.

The Iranian government is seeking to strengthen industry by encouraging modern technology and increasing productivity and quality standards. Iran has been starved of international investment in numerous areas during the sanctions' era, and the Iranian government is now committed to entering the global market and has established many new ground rules to protect and guide foreign investors who want to do business in Iran. This is in addition to the Foreign Investment Promotion and Protection Act of 2002 which allows foreign companies to invest in factories and industries in Iran, own 100% of the business in most sectors and transfer capital freely. There is a huge potential for British companies to profit from this alliance as this is the last remaining major economy to enter the global market.

Iran is looking for industrial supplies such as machinery, iron, steel, transport vehicles, tools and appliances. Other import opportunities include technical services, telecoms, capital goods and consumer goods such as clothing and electronics to satiate the growing middle class who have a strong preference for foreign-made products. Also, there are significant opportunities in the oil and gas, petrochemicals, automotive, water treatment, power and healthcare sectors. It is important to note that Iran allows 100% foreign ownership, except in industries such as nationalised oil and gas, parts of the real estate, and banking and insurance sectors.

Due to the sanctions relief and improved economic outlook of Iran, we have identified several strategic sectors that we believe are key for British business people to consider. These include oil and gas, mines and minerals, telecommunications, the banking and finance sector, renewable energy, transportation, water and waste management, healthcare and pharmaceuticals, agriculture, consumer goods and new technology. Please read on for more details on each of these sectors.

Oil and Gas

Iran's most important economic sector is oil and gas, accounting for 82% of the country's export revenues in 20162. With proven reserves of at least 158 barrels, Iran holds almost 10% of the world's proven oil reserves and possesses the world's fourth-largest crude oil reserves. It also has one of the world's largest untapped natural gas reserves; Iran's proven natural gas reserves are 1200 trillion cubic feet, which is the second largest proved amount of natural gas in the world (around 15% of the total.) Interestingly, due to Iran's diversified economy, it is the least dependant on crude oil and gas among the major Middle Eastern oil-producing countries.

Now that the sanctions have been lifted, production is expected to grow significantly, as the Iranian government has signalled its intention to boost gas and oil production. Therefore, there is a real need for more investment to upgrade and enhance oil recovery techniques. The Iranian National Oil Company estimated that US$185 billion of investment is required into the oil and gas sector, with the NIOC keen to attract qualified international companies to participate in the development of the Iranian oil and gas sector3. Britain's expertise in the oil and gas sectors is acknowledged by Iranian institutions which are keen to trade with British companies in this sector.

To start things off, France's Total signed a $5 billion deal with Tehran in July 2017 to develop Iran's South Pars; the world's largest gas field. This is the first major western energy investment in the country since Tehran signed an international nuclear deal, and Total will now go ahead with phase 11 of the South Pars project in the summer of 20174. This bodes well, now the financial sanctions are lifted, for UK companies to take advantage of the significant opportunities that lie ahead for international companies in Iran.

Mines and Minerals

Iran has the world's largest zinc reserves and second-largest reserves of copper. It also has important reserves of iron, uranium, lead, chromite, manganese, coal and gold among many others. There are approximately 9,000 mines in Iran valued at around $700 billion5. The reason that mining does not constitute the largest percentage of the country's GDP however, is that to date the mining industry remains underdeveloped. The largest untapped value is in copper, iron ore, zinc and coal.

The government is actively encouraging foreign participation in developing its mineral resources. This could prove fruitful for companies who can offer equipment, know-how or investment.

Unlike in the oil and gas sector, foreigners can own 100 percent of the mining rights for a discovery.

Telecommunications

Iran is one of the fastest growing telecommunications markets in the Middle East and aims to become a Middle Eastern market leader. With it's strong scientific and engineering tradition, and a young, mobile population eager to participate in the digital economy, Iran has the potential to develop a thriving telecommunications sector.

There is a mobile penetration of over 110% in Iran, indicating that a good number of Iranians own more than one active phone. Recent statistics suggest that around half the population have a smartphone.

With Iran's telecoms' market providing one of the largest non-oil revenue growth opportunities, the government has introduced many privatisation measures and is promoting private investment despite traditionally having a monopoly on both mobile and landline services.

Banking and Finance Sector

The banking sector in Iran includes 30 registered banks, 10 of which are government owned and 20 of which are privately owned. The four largest private banks in Iran are Melli, Saderat, Tejarat and Melat.

The central bank of Iran has said that it will increase efforts to attract foreign investment into private banks, and investors are permitted to have up to 40% ownership in banks located in mainland Iran and 100% ownership in banks located in the Free Trade Zones6.

Also, in early 2016 Iran banks were reconnected to the SWIFT network which means they can resume cross-border transactions with foreign banks7, where those banks are willing to accept payment from Iran. However, transactions involving the US Dollar remain prohibited which is making international banks and companies cautious about re-entering the market. Nevertheless, some banks and financial institutions with no US exposure are willing to conduct business with Iran.

Once foreign investors obtain a trading licence and investment code, they can open bank accounts in local currency with Iranian banks and trade stocks on the TSE subject to certain limitations. Licenced foreign investors can transfer funds to Iran to finance their operations, and under the 2010 Regulations, they have the right to repatriate the original capital, as well as any capital gains and dividends earned.

Renewable Energy

Iran is seeking to develop renewable energies to reduce its air pollution in major cities and enable it to export more of its hydrocarbon resources. Iran contains significant potential for solar, wind and geothermal energy, and along with its special geopolitical location, renewable energy could be a very profitable area for investment in the coming years. According to a report by the Iranian Ministry of Energy, the wind energy potential of Iran is estimated at more than 30,000 megawatts. Also, the Ardebil and East Azerbaijan provinces are considered rich in geothermal energy, and the central and southern regions have a high solar energy potential8.

Indeed, some experts believe that Iran has the potential to become an electric hub in the coming years, as the production of renewable energy is set to exceed local demand. To speed up renewable energy production, the Iranian government has relaxed investment rules and is offering special incentives to encourage both local and foreign investors to work in the renewables sector9.

Transportation

Iran is determined to reinforce and update the infrastructure of transport links to accommodate the predicted population growth and economic expansion.

1. Roads

The sixth five-year plan (2016-2021) clearly states the need to link provincial capitals with railway, freeway and highway networks.

2. Railways

Iran is prioritising the modernisation and expansion of its rail infrastructure, and the government has already invested billions in recent years into the railways. It is also resolute on attracting foreign investment, as it plans to expand its rail network to 25,000 km by 2025, (according to The Railways of Islamic Republic of Iran the railway network extended to 11,000 km in 2016.)

3. Aviation

Iran's aviation infrastructure is also in need of investment, and since the international sanctions were lifted, Iran has placed orders for 300 new aircraft. These orders are extremely important to Iran, as before this they were having use part of their planes to repair others, to keep them in working condition; the poor state of the aviation industry in Iran has been a symbol for the impact of the sanctions on Iran. Europe's Airbus and Boeing have accrued orders from Iran for around 300 planes, along with orders from smaller rival companies. These orders add up to several tens of billions of dollars' worth of business.

Water and Waste Management

Recent estimates show that Iran is set to spend USD 20 billion on water and wastewater infrastructure over the next five years, including seawater desalination and advanced wastewater treatment and reuse. Therefore, Iran is actively looking for foreign investment and expertise in the water and wastewater industries.

Agriculture

This sector constitutes a large part of the country's economy and employs around 18% of the total workforce. In this large and varied sector, Iran is well known for pistachios, saffron and caviar. The main farming products are wheat, sugar, potatoes, tomatoes, barley and rice, along with apples and grapes.

This sector needs modernisation, which will come from foreign investment, to expand trade, and improve biotechnology, machinery, irrigation, and greenhouse technologies. This is especially important in the face of rising demand from a growing population, and therefore this growth needs to be accompanied by careful management of water recourses, as this is where most OF Iran's water is used.

Healthcare and Pharmaceuticals

The Iranian healthcare market was estimated to be worth around USD 96 billion in 2017 and, as the young population grows, there is a wide range of opportunities open to investors who seek to do business in this market.

Iran's healthcare system is dominated by governmental presence, and has a largely self-sufficient drug production infrastructure; internal production meets 96% of the domestic demand. Iran is committed to modernising the infrastructure and injecting higher efficiency and productivity into the system, by encouraging the private sector to participate more. The government is intent on increasing public healthcare spending, improving quality of services and increasing access to healthcare services. It has forecast a $17 billion investment will be required over the next five years to meet these requirements, and the government is looking to attract foreign investment to develop hospitals and medical centres.

Medical tourism to Iran has also become one of the most lucrative markets around the world. WHO (World Health Organization) estimates the global medical tourism market is valued at more than USD 100 billion.

Consumer Goods

Currently, Iran-made products dominate the local market; these industries have been allowed to thrive in Iran as they have been shielded from global competition by sanctions, import tariffs, or other protectionist barriers. However, this has had a negative impact on their economy and has slowed down their modernisation.

There, therefore, needs to be a large investment in this sector to improve the productivity, equipment and technology, to give Iran the potential to become internationally competitive and start exporting its goods onto the larger, global market.

Also, due to the relative monopoly of domestic companies that the sanctions created, there is currently a lack of authentic, international products in Iran. This presents a real opportunity for international companies to start exporting their products to Iran. The Iranian consumer market is growing, and is incredibly brand conscious, and appreciates the quality of Western products. We hope you have found this page informative, please read on to the next section to find out further information about how the JCPOA will affect future trade relations between the UK and Iran. This material has been written for general information purposes only and has been obtained from various public media outlets and news agencies. To the best of our knowledge, the information is error-free, complete and accurate, but we reserve the right to disclaim all implied warranties.

New Technology

Start-ups and e-commerce apps are thriving in Iran, driven by young, educated Iranians educated at home and abroad. In the absence of the major global players such as Amazon and Uber, home-grown equivalents such as Digikala and Snapp have been allowed to grow rapidly.

The e-commerce and tech sector, therefore, constitutes a very attractive sector to foreign investors as it is growing exponentially. Many young Iranians have returned from the US and Europe to start-up companies in their homeland, which has been relatively untouched by global companies that traditionally have a monopoly in their markets. This environment has bred creativity and innovation, as the youth of Iran experiment with using technology to facilitate their modern lives following global standards.

An opportunity to meet with these new companies will take place in April 2018, as Silk Road Start-up will arrange the first gathering of Iranian start-ups with an international community.